The allotment of the Initial Public Offering (IPO) of Nepal’s much hyped dream hydropower project ‘Upper Tamakoshi Hydropower Project’ was finally concluded today Tuesday afternoon 27th November 2018 (11 Mangsir 2075) by Sunrise Capital Ltd., its issue manager. The allotment was held at 3:00 PM amidst a program organized at Crystal Banquet, Babarmahal, Kathmandu. According to the issue manager, Sunrise Capital Ltd., the issue has been able to attract the most number of applicants in the history of Nepalese stock market. A total of 3,39,775 applicants had applied for 1,50,90,750 unit shares of the company with the the total demand of 4,46,18,843 unit shares with the final worth of over Rs 6.70 billion. The issue was thus oversubscribed by 4.46 times.

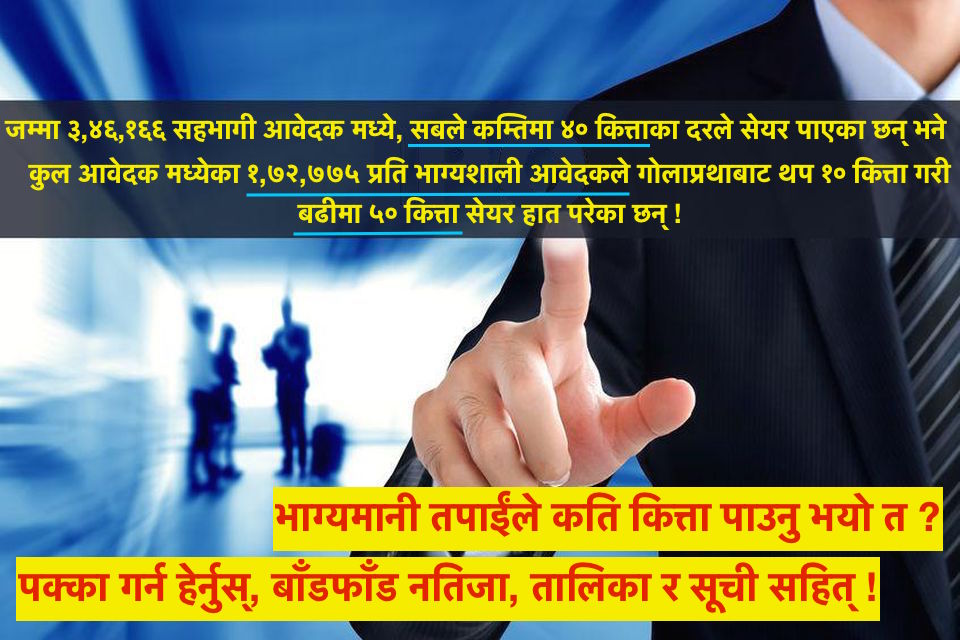

Of the total applications, 5,700 have been disqualified due to double application. All the 3,34,075 valid applications were initially each allotted a minimum of 40 unit shares, while 1,72,775 of these applications were each lucky enough to receive additional remaining 10 unit shares through the lottery system.

Citizen Investment Trust (CIT) and Sunrise Capital Ltd. have been appointed as the issue managers for the IPO issuance. The hydropower company had floated 15,885,000 unit total shares for the general public, i.e., 15% of their paid up capital.

Check the link below to read/download the ALLOTMENT MODULE and RESULTS:

Citizen Investment Trust (CIT) and Sunrise Capital Ltd. have been appointed as the issue managers for the IPO issuance. The hydropower company had floated 15,885,000 unit total shares for the general public, i.e., 15% of their paid up capital.

Check the link below to read/download the ALLOTMENT MODULE and RESULTS: