IPO ALLOTMENTS:

Madhya Bhotekoshi Jalvidyut Company Limited (MBJCL) initial public offer (IPO) allotment results of first and second phase are both successfully made at 3:00 PM in Smart Café and Banquet, Dhumbarahi, Kathmandu. The company had floated 1.17 crore unit shares for the members registered in Employees Provident Fund (EPF) in its first phase of issuance, starting from 28th Kartik lasting till 14th Mangsir 2075. Soon after starting from 19th Mangsir 2075, the company then floated in the second phase of issuance 21 lakh unit shares for the employees of the promoter companies and 6 lakh unit shares for the employees of the Provident Fund lasting till 26th Mangsir 2075.

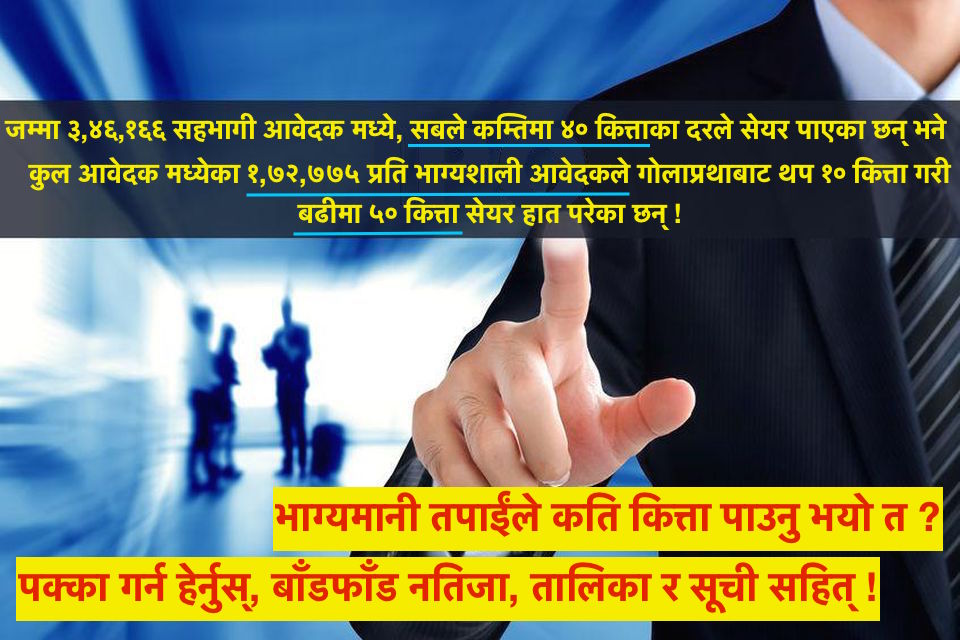

The first phase issue was 3.11 times oversubscribed with 139,778 valid applications worth Rs 3,63,95,39,000 for 3,63,95,390 unit shares. Of these, all 24,866 applicants applying for 50 to 90 are each allotted in full as demand while 114,912 applicants applying for 100 to 500 are each allotted 90 unit shares, but the remaining 4,543 lucky ones of these are also allotted 10 additional unit shares by lottery making a maximum of 100 each.

The second phase issue was 1.68 times oversubscribed with 8,439 valid applications worth Rs 35,95,000 for 35,950 unit shares. Of these, all 573 applicants applying for 50 to 250 are each allotted in full as demand, while 7,866 applicants applying for 260 to 500 are each allotted 250 unit shares, but the remaining 1,712 lucky ones of these are also allotted 10 additional unit shares by lottery making a maximum of 260 each. Similarly, 612 valid applicants from employees of Provident Fund applying for 6 lakhs unit shares are also allotted as per the allotment module prepared by EPF.

Global IME Capital Limited was appointed as the issue manager while NIBL Ace Capital, Prabhu Capital, Laxmi Capital, Sanima Capital, Civil Capital and CBIL Capital were appointed as other co-issue managers.

Check the RESULTS HERE: