Shivam Cements Limited (SCL) has successfully concluded its initial public offer (IPO) on Wednesday morning 10:30 AM onwards today, 6th March 2019 (22nd Falgun 2075). The company had floated 2% shares of the its issue capital, that is, 8,80,000 unit shares at a face value of Rs 200 per unit share to the project affected locals and 10%, that is, 44,00,000 unit shares at a face value of Rs 300 per unit shares to the general public, initially for four working days, starting from Monday 18th February 2019 (6th Falgun 2075) to Thursday 21st February 2018 (9th Falgun 2075), and due to undersubscription then extended for additional four working days till 26th February 2019 (14th Falgun 2075) for full subscription just last week.

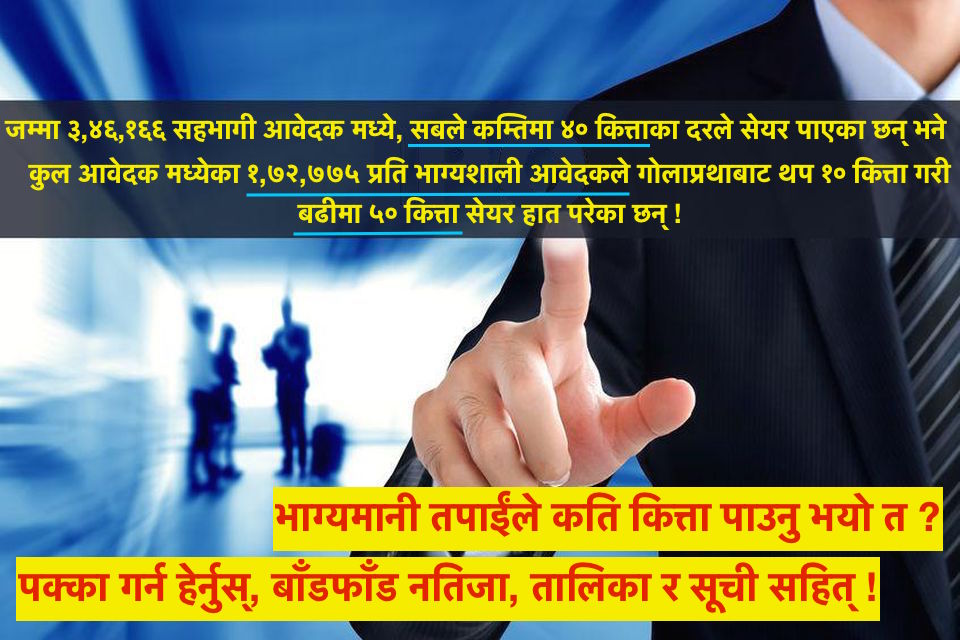

According to Siddhartha Capital Ltd., its issue manager, there were 51,898 applications from the general public for 5,191,160 unit shares, collecting a total of Rs 1.56 billion with 1.26 oversubscription, while there were 1,898 applications from the local public for 489,900 unit shares with only 89% subscription, leaving 98,334 unit shares that will also be allotted to the general public for its oversubscription. Of the total 1898 local applications for 785,405 unit shares, only 1 application for 100 unit shares was rejected due to error and the remaining 785,305 valid applications were included in the allotment process of which applicants for 50 to 1,300 unit shares were allotted in full as per their demand, while applicants for 1,500 to 10,000 unit shares were allotted 1,350 unit shares each on pro rata basis, thus leaving none empty handed.